Table of Contents

Introduction

For many years, MarTech architecture was treated as a technical concern – something marketing teams delegated to IT or vendors once business requirements were agreed. As long as campaigns could be launched, data could be analysed, and dashboards looked impressive, architecture decisions rarely surfaced beyond project teams.

The era is over

Across Asia Pacific, data sovereignty has moved decisively from a legal footnote to a strategic buying criterion. Today, the way a MarTech stack is architected determines not just what marketers can do, but where they can operate, how fast they can scale, and how much regulatory risk they carry. In some markets, it even determines whether a platform can be used at all.

Having worked across APAC markets over the years, spanning developed economies, emerging markets, and heavily regulated environments, one pattern has become increasingly clear: architecture choices now outlive campaigns, tools, and even vendors.

This article explores why data sovereignty has become a defining issue for MarTech in APAC, why global best practices often break down in the region, and why leaders must now treat MarTech architecture as a long-term strategic decision rather than a tactical implementation detail.

What Data Sovereignty Mean in a Modern MarTech Context

Before discussing architecture, it is worth aligning on what data sovereignty means, because many organisations still conflate it with simpler concepts like data residency.

Data residency typically refer to where data is physically stored.

Data sovereignty, however, goes much further. It encompasses:

- Who owns the data

- Who can access it, and from where

- Where data is processed and transformed

- Which laws apply at each stage of the data lifecycle

In MarTech context, this distinction matters enormously.

Marketing data today is no longer limite to anonymised campaign metrics. It includes:

- Customer identity and profie data

- Behavioural signals across web, app, and offline touchpoints

- Consent and preference records

- Transactional and financial indicators in regulated industries

- AI-derived attributes such as propensity scores and segmentation

In many APAC markets, this combination increasingly qualifies as personal data, sensitive data, or strategically important data. As a result, marketing platforms are now subject to regulatory scrutiny that historically applied only to core systems.

This is why data sovereignty can no longer be addressed after the fact. Once data pipelines, identity resolution, and AI models are designed, retrofitting sovereignty controls becomes expensive, slow, and politically difficult.

Why APAC Fundamentally Changes the MarTech Playbook

Global MarTech vendors often promote architectures that work well in North America or Europe: centralised data platforms, regional cloud hubs, and unified customer views spanning multiple countries. On paper, these designs promise efficiency, scale, and consistent insights.

In APAC, reality is more complex.

APAC Is Not One Regulatory Market

Asia Pacific is a region of extremes. In includes:

- Highly mature regulatory environments with strong enforcement

- Rapidly evolving emerging markets where laws are still being shaped

- Countries that prioritise economic openess, and others that prioritise data control as a matter of national interest

The result is regulatory fragmentation, not convergence.

In practice, this means:

- Similar MarTech architectures may be acceptable in one market but questioned in another

- Enforcement timelines and expectations differ widely

- Local regulators often interpret broadly worded laws very differently

For organisations operating across multiple APAC markets, this creates a fundamental tension between standardisation and compliance.

The Decline of the “Regional Hub” Model

For many years, a common APAC pattern was to centralise MarTech platforms in a regional hub – often in a market with strong cloud infrastructure and perceived regulatory stability.

This model is now under pressure.

Regulators across the region are increasingly interested not just in where data is stored, but in:

- Where it is processed

- Who can access it

- Whether raw personal data leaves national borders

- How AI models are trained and governed

In this environment, architectures optimised purely for efficiency often struggle under regulatory review. What once look like good engineering can quickly become a compliance liability.

Data Sovereignty Is Now a MarTech Buying Criterion

One of the clearest shifts in recent year is now MarTech platform are evaluated.

Where procurement discussions once focused on features, integrations, and licencing costs, today they increasingly include:

- Architecture diagrams

- Data flow maps

- Access and identity models

- Country-level deployment options

Legal, risk, and compliance teams are no longer brought in at the end of a project. In many APAC organisations, they are involved before a vendor is even shortlisted.

Typical executive questions now include:

- Where exactly is customer data processed?

- Can data be isolated by country if required?

- Who has administrative access, and from which jurisdictions?

- How are cross-border transfers governed and audited?

Vendors that cannot answer these questions clearly often struggle to progress beyond early evaluation stages, regardless of how strong their marketing capabilities appear.

The implication for marketing leaders is significant: MarTech selection is no longer just a marketing decision. it is an enterprise decision with long-term architectural consequeces.

Architecture Choices that Matter in a Sovereignty-First World

When data sovereignty becomes a constraints, not all architectures are created equal.

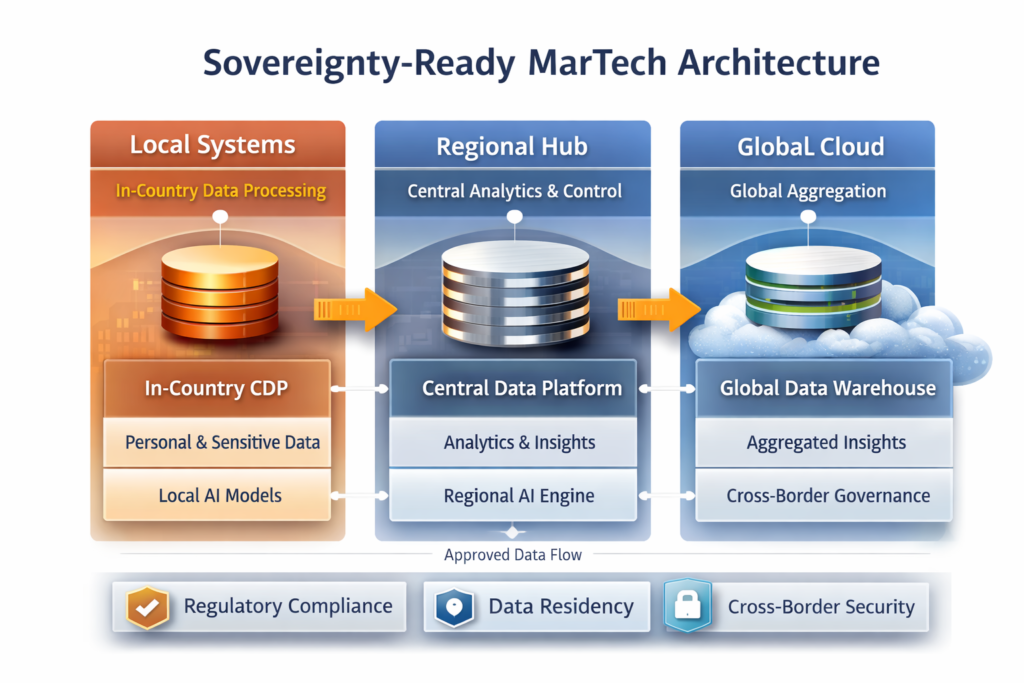

Centralised vs Federated MarTech Architectures

At a high level, organisations face a choice between:

- Highly centralised architectures, where customer data from multiple markets is consolidated into a single platform

- Federated or modular architectures, where data is processed locally and aggregated selectively

Centralised models ofter simplicity and a unified customer view. However, they also concentrate risk. If regulatory requirements change in one market, the entire architecture may need to be revisited.

Federated models are more complex to design, but they offer greater resilience. By keeping sensitive data closer to its source and sharing only what is necessary, organisations gain flexibility in responding to regulatory change.

From experience, the most sustainable APAC architectures tend to be intentionally hybrid: centralised where possible, localised where necessary, and explicit about data movement at every stage.

Cloud, Hybrid, and In-Country Deployment Models

Cloud adoption has a major enabler of MarTech innovation, but it is not a universal solution.

In sovereignty-sensitive markets, organisations increasingly adopt:

- Hybrid cloud models

- In-country deployments for specific workloads

- Clear separation between operational data and analytical aggregates

What matters is not whether a platform is “cloud-based”, but how controllable and auditable its data flows are.

The Hidden Risks: Data Flows, Not Data Storage

One of the most common mistakes organisations make is focusing solely on data storage locations. In practice, many sovereignty breaches occur during:

- Event ingestion and tracking

- Identity resolution

- Real-time personalisation

- AI model training

Each of these steps can involve cross-border processing, even if data is ultimately stored locally. Without deliberate architectural design, these flows remain invisible until regulators or auditors start asking questions.

APAC in Practice: Vietnam as a Brief Illustrative Example

Vietnam provides a useful illustration of how data sovereignty is becoming structural rather than theoretical in APAC.

Between 2024 and 2026, Vietnam introduced a new generation of data regulations that collectively treat data as a strategic national asset, not merely a privacy concen.

The Data Law (Law No. 60/2024/QH15), passed in late 2024 and effective from 1 July 2025, establishes national data infrastructure and introduces formal data classification such as core data and important data. For these categories, cross-border transfers may require prior approval from the Prime Minister or the Ministry of Public Security following a security assessment (Government of Vietnam, Data Law 2024).

This framework directly affects MarTech platforms that centralise customer profiles or analytics at a regional or global level.

The Personal Data Protection Law (Law No. 91/2025/QH15), effective 1 Jan 2026, elevates earlier degree-level requirements into statute. It applies extraterritorially to any organisation processing the personal data of Vietnamese citizens and introduces stricter impact assessment requirements for cross border data transfers, with penalties reaching up to 5% of annual turnover for certain violations (Government of Vietnam, PDP Law 2025).

In prallel, the updated Cybersecurity Law (2026) strengthens the authority of the Ministry of Public Security over data integrity, digital identities, and cross-border access, reinforcing data control as a matter of national security (Ministry of Public Security).

The key takeaway for MarTech leaders is not the legal detail, but the architectural implication: centralised MarTech stacks must now be designed with explicit sovereignty controls.

Vietnam is best viewed not as an outlier, but as an early signal of a broader APAC trajectory.

Designing a Sovereignty-Ready MarTech Stack for APAC

So what does a sovereignty-ready MarTech stack actually look like?

Based on experience across the region, several principles consistently emerge.

Design for Sovereignty by Default

Rather than asking how to retrofit compliance later, leading organisations design with sovereignty in mind from day one:

- Data minimisation as a default

- Clear separation between personal, sensitive, and aggregated data

- Explicit data contracts between systems

This reduces ambiguity and makes regulatory conversations far easier.

Control Data Movement, Not Just Storage

A sovereignty-ready architecture is explicit about:

- Where data is collected

- Where it is processed

- Where data can cross borders, and under what conditions

Aggregated insights often travel far more easily than raw data. Designing for this distinction preserves analytical value while reducing regulatory exposure.

Balance Central Governance with Local Execution

In APAC, success MarTech governance typically follows a “central standards, local execution” model:

- Central teams define architecture principles, tooling standards, and security controls

- Local teams adapt execution to regulatory and market realities

This balance avoids fragmentation while respecting sovereignty contraints.

Why Data Sovereignty Is a Strategic Advantage, Not a Constraint

It is tempting to view data sovereignty as a brake on innovation. In practice, the opposite is often true.

Organisations that invest early in sovereignty-ready architectures benefit from:

- Faster regulatory approvals

- Reduced re-platforming costs

- Greater trust with regulators and partners

- More resilient AI and personalisation strategies

In contrast, organisations that optimise purely for short-term efficiency often accumulate what might be called compliance debt – debt that eventually must be paid through re-architecture, delayed launches, or constrained capabilities.

In APAC, where regulatory landscape continue to evolve, reliance is a competitive advantage.

Conclusion: In APAC, Architecture is Strategy

Data sovereignty is no longer an abstract concept reserved for legal teams. In Asia Pacific, it has become a defining factor in how MarTech platforms are selected, designed, and scaled.

Architecture decisions now determine:

- Which markets an organisation can operate in

- How quickly it can respond to regulatory change

- How confidently it can invest in AI-driven marketing

Vietnam offers a useful illustration of this broader shift – but it is far from alone. Across APAC, regulators are signalling that data control, transparency, and accountability are here to stay.

Fo marketing and technology leaders, the message is clear:

MarTech architecture is no longer just an implementation detail. It is a strategic choice that shape growth, risk and trust for years to come.

Read more on the articles I have written here

FAQs

-

What is data sovereignty in MarTech?

Data sovereignty in MarTech refers to how customer and marketing data is stored, processed, accessed, and governed under a country’s laws, not just where it is hosted.

-

Why is data sovereignty especially important in APAC?

APAC has fragmented and fast-evolving data regulations, meaning MarTech architectures that work in one market may not be compliant in another.

-

Does data sovereignty mean marketing data must stay in one country?

Not always, but many APAC markets impose strict controls on how personal or sensitive data can be transferred, processed, or accessed across borders.

-

How does data sovereignty affect MarTech architecture decisions?

It influences whether MarTech stacks should be centralised, federated, or hybrid – directly impacting scalability, compliance risk, and long-term flexibility.

-

Is data sovereignty a compliance burden or a strategic advantage?

When designed early, sovereignty-ready MarTech architectures reduces regulatory risk, speed market expansion, and create a stronger foundation for AI-driven marketing.